Tax Information

How can LA County Library help me with my taxes?

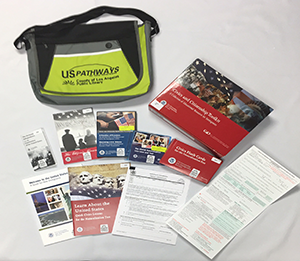

LA County Library provides free information and resources to help with your California state and federal income taxes. We know tax season can be stressful, so we’re here to help.

On this page you will find information on the California Franchise Tax Board, the Internal Revenue Service (IRS), VITA (Volunteer Income Tax Assistance), MyFreeTaxes.com, and other services and resources.

Free tax assistance information

MyFreeTaxes

Provides easy, free, tax help you can trust. The MyFreeTaxes Partnership provides free state and federal tax preparation and filing assistance. It’s easy, safe, secure and 100 percent free.

AARP Foundation Tax-Aide

Offers free, individualized tax preparation for low-to moderate-income taxpayers – especially those 60 and older – at more than 5,000 locations nationwide.

VITA (Volunteer Income Tax Assistance)

VITA offers free tax help to people who need assistance in preparing their own tax returns, including people who generally make $64,000 or less and need assistance in preparing their own tax returns. IRS-certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals in local communities. Assistance is generally available from February 1 through April 15th. The VITA program specializes in assisting disabled taxpayers, those with low to limited income, and non-English speaking taxpayers.

Government Agencies

IRS (Internal Revenue Service)

Los Angeles Field Office

300 N Los Angeles St

Los Angeles, CA 90012

Phone: 213.576.3009

California FTB (Franchise Tax Board)

Los Angeles Field Office

300 S Spring Street, Suite 5704

Los Angeles, CA 90013

Phone: 800.852.5711

24/7 Automated: 800.338.0505

Website: www.ftb.ca.gov/E-File: CalFile

Frequently Asked Questions

Call your local library to make sure the form you need is available.

Yes, library staff will print a specific form upon request but you will need to view instructions, tables, and schedules online. Staff cannot provide advice to you about which form you need.

Once a library runs out of forms, you will need to pick them up from a different library. Staff can help you locate a form at another nearby library, if they are still available.

Tax forms can be picked up at your local library.